Easily Understand Your Finances With The Financial Health Check Template Today

What Taxes do Small Businesses Pay? Intro to Business Taxes

Learn what taxes small businesses pay. We discuss LLC taxes, c-corp taxes, employee taxes, sales tax, payroll tax, income tax, self-employment tax, and more.

TAXBUSINESS

David Kindness, CPA

9/20/2024

What Taxes do Small Businesses Pay? Intro to Business Taxes

Published on July 22, 2024

Written by David Kindness, CPA

Why you can trust Your Creative CPA

Our content is written, edited, or both by industry experts who are creative entrepreneurs just like you. Learn more.

Navigating the complex world of small business taxes can be daunting. However, understanding the different types of taxes, as well as the deductions and credits available to you, can help you minimize your tax liability and ensure compliance with tax laws. This article will provide a comprehensive overview of small business taxes, covering key topics such as income tax, self-employment tax, payroll taxes, sales tax, deductions, credits, recordkeeping, estimated taxes, and tax planning.

The information in this article will help you lower your tax burden, save time on tax recordkeeping, and most importantly, stay out of trouble with the IRS. Read on to learn about the basics of taxes for businesses.

Income Tax

Income taxes are one of the primary taxes that all taxpayers must pay every year on the income they earn during the year. When people refer to "tax season", this is the tax they're generally referring to. All business owners must pay income taxes to some degree, but owners of passthrough entities, which are partnerships, s-corps, and sole proprietorships, must pay taxes on income after all expenses (more on this below).

What is Income Tax?

Income taxes are taxes paid on income earned from a full-time job, running a business, freelancing, or performing side gigs. The income you receive from these jobs is usually reported to you on Form 1099, which you receive in January following each tax year. In the US, income taxes must be paid to the federal government and to most state governments every year on Form 1040.

Who Pays Income Tax?

Income taxes are required to be paid by individuals, employees, freelancers, small businesses, LLCs, and c-corporations Partnerships and s-corporations do not pay income taxes because the income they receive is automatically passed through to the partner's or shareholder's tax return.

How to Pay Income Tax

Income taxes are paid throughout the year and with your income tax return. Employees generally pay income taxes with every paycheck and with their income tax return (if necessary). Freelancers, small businesses, LLCs, and c-corps all pay their taxes quarterly and with their income tax return (if necessary).

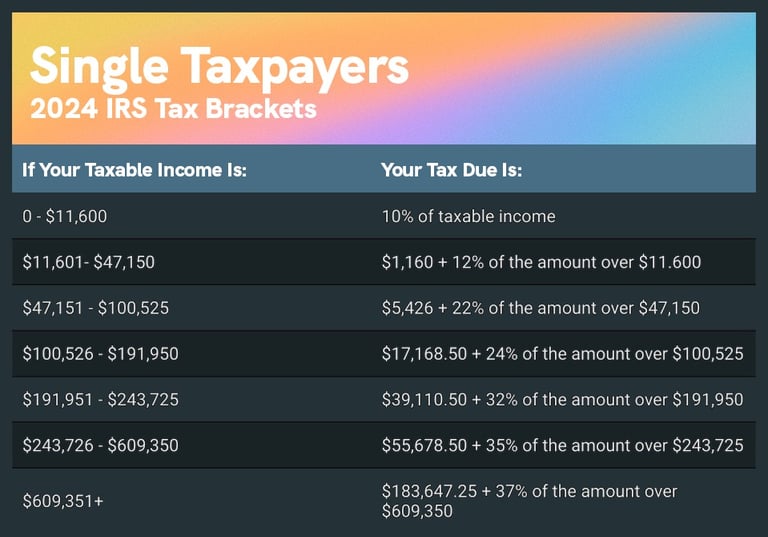

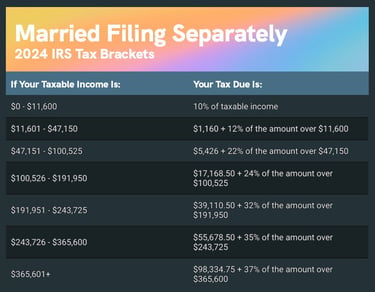

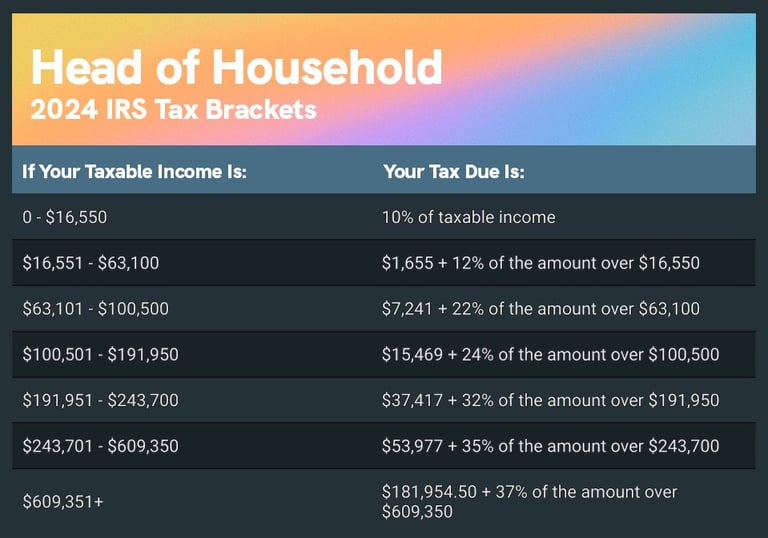

Income Tax Rates

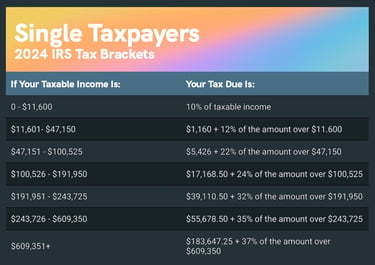

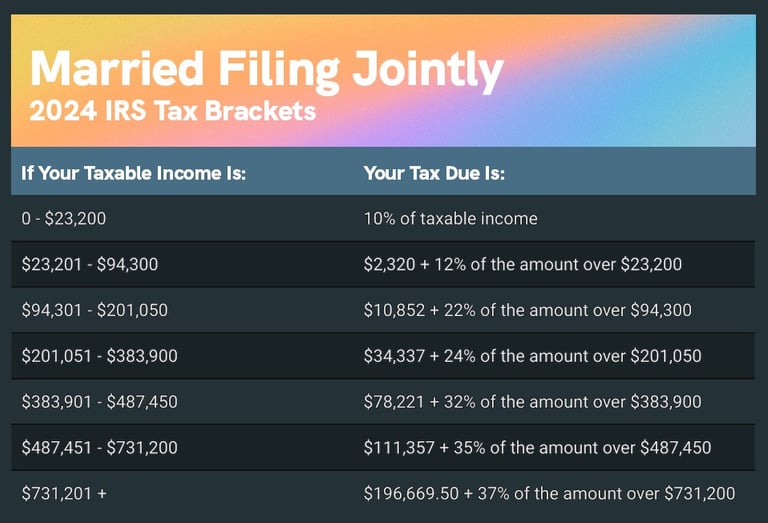

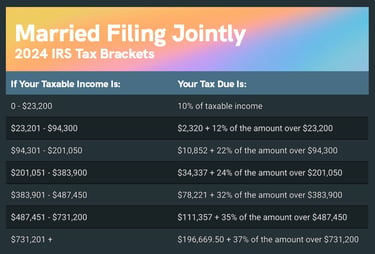

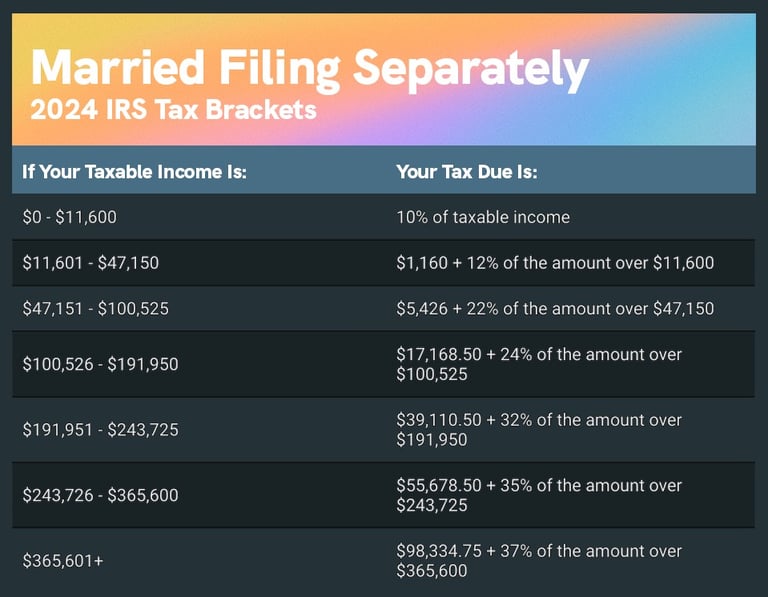

Income tax rates, also known as tax brackets, change each year depending on inflation, cost of living, tax law changes, and more. Tax rates are also different depending on your filing status, which is determined by your marital status and child status. Most states also charge income tax, although a handful do not. States with no income tax include Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Below are the federal income tax brackets for each filing status:

"A person doesn't know how much they have to be thankful for until they have to pay taxes on it."

Ann Landers

"The hardest thing in the world to understand is the income tax."

Albert Einstein

Self-Employment Tax

Self-employed individuals, such as sole proprietors and independent contractors, are subject to self-employment tax, also known as FICA taxes (the Federal Insurance Contributions Act), on the income they receive. The FICA tax is made up of both Social Security and Medicare taxes. The self-employment tax rate is 15.3%, which is calculated as follows:

Social Security Taxes: 12.4%

Medicare Taxes: 2.9%

In comparison, employees pay half as much - 6.2% in Social Security taxes and 1.45% in medicare taxes - while employers pay the other half of both.

Corporate Income Taxes

C-corporations are required to pay taxes on the income they produce during their regular operations, just like how an individual must pay taxes on income they receive from their job. Currently, the corporate tax rate is 21%, but this could change when Donald Trump's Tax Cuts and Jobs Act (TCJA) sunsets after 2025. When a C-corporation pays out dividends, the stockholders who receive these dividends must pay taxes on this income as well. This is known as double taxation.

Other business types, like S-corporations, partnerships, and sole proprietorships, are not required to pay corporate income taxes. Instead, these types of entities are known as "passthrough entities", which means that their net income (income after all expenses) is passed through to their owners, who then pay taxes on that income. As a result, the business never pays income taxes.

Payroll Taxes

Businesses with employees are responsible for withholding payroll taxes, including federal income tax, state income tax (if applicable), Social Security tax of 6.2%, and Medicare tax of 1.45% from employees' paychecks. Employers must also match the employee portion of Social Security and Medicare taxes on their own.

Additionally, businesses may need to pay federal unemployment tax (FUTA) and state unemployment taxes. The standard FUTA tax rate is 6%, which is charged on only the first $7,000 of each employee's wages, so employers pay a maximum of $420 per employee each year. However, employers in most states receive a 5.4% credit on this tax, so they only pay 0.6%, or $42, per employee per year.

Currently, California and New York have FUTA tax credits of only 4.8%, so the effective rate in these states is 1.2%, or $84 per employee per year.

Sales Tax

Businesses that sell tangible goods or certain services in states with sales tax are required to collect and remit sales tax to their state government. The specific sales tax rate varies by state and may also be affected by local jurisdictions. Most states charge sales tax, but a handful do not. States with no sales tax include Alaska, Delaware, Montana, New Hampshire, and Oregon.

How Does Starting a Business Affect My Taxes?

Starting a business could have a significant impact on your tax situation. Business taxes can be much more complicated than individual taxes, but starting a business can actually offer some tax benefits. For example, you might be able to deduct business expenses from your income, which you can't do as an employee. That could mean deducting a portion of your rent or mortgage, utilities, internet and phone bill, and more to lower both your income and your taxes.

If you're unsure of how starting a business could affect your taxes and want to learn more, consider contacting a tax professional to discuss your specific situation.

How to Lower Your Taxes as a Small Business Owner

There are a few strategies to lower your taxes as a small business owner. First, understand what counts as income and what doesn't, so you only include payments that you should actually be taxed on. Next, understand your potential business expenses and tax deductions and do what you can to maximize them (without breaking any tax laws of course). Finally, utilize tax credits when filling out your tax return, which can lower your tax bill dollar-for-dollar and can be a powerful way to save money on taxes.

How to Manage Your Taxes While Staying Creative

Understanding the taxes you're responsible for paying - and understanding how to minimize them - are the keys to staying on top of your tax situation and saving money. As a small business owner, freelancer, or gig worker, you might be responsible for paying the following taxes:

Income Tax (federal and state)

Self-Employment Tax

Payroll taxes (if you have employees)

Sales tax (if you sell physical products or some types of services)

Use these strategies to help lower your tax bill:

Only include legitimate business income on your tax return

Maximize your business expenses and tax deductions

Utilize tax credits when filling out your tax return

By following the guidance in this article, you can understand your taxes, reduce your tax bill, save money, and stay out of trouble with the IRS.

Frequently Asked Questions (FAQs)

What are the primary types of taxes that small businesses must pay?

Income tax

Self-employment tax

Payroll taxes

Sales tax

How do I determine the best legal structure for my small business in terms of tax implications?

Consult with a tax professional or attorney to assess the advantages and disadvantages of different legal structures, such as sole proprietorship, partnership, LLC, or corporation.

What is the difference between employee taxes and self-employment taxes?

Employees have their taxes withheld from their paychecks and are only responsible for paying half of Social Security and Medicare (FICA) taxes, while their employers pay the other half. Self-employed individuals are responsible for calculating and paying their own taxes throughout the year - generally on a quarterly basis - and are responsible for paying all of the Social Security and Medicare taxes.

When do I need to start paying estimated taxes?

Businesses that expect to owe more than $1,000 in federal income tax for the year are generally required to make quarterly estimated tax payments.

What are some common business deductions that can help reduce my tax liability?

Business expenses (rent, utilities, office supplies, advertising)

Depreciation

Home office deduction

Employee wages and benefits

Travel expenses

What records should I keep to support my tax deductions and credits?

Consider keeping the following types of records to prove your business expenses, tax deductions, and credits...

Income and expense records

Receipts

Invoices

Bank statements

Mileage logs

Disclaimer: the information provided in this article is for educational purposes only and does not constitute tax, accounting, investing, legal, or financial advice. The information in this article does not take into account your unique financial or business situation or goals, and YCCPA cannot be responsible for reader's financial decision-making. YCCPA's goal is to educate and support you on your creative business journey.

Written by David Kindness, CPA

David is a CPA (Certified Public Accountant) and professional photographer, videographer, and designer based in San Diego, California. Learn more.

Supported by Ads

Your Creative CPA is supported by the ads you may see in our articles and guides. These ads help us serve creatives like you.

financial wisdom for creatives, by creatives

Created by David Kindness

© 2025 Your Creative CPA | Terms

type1wild.com partner

Exclusive guides and tools for creatives, right to your inbox.